Medical device and MedTech insights, news, tips and more

Neovasc Closes $11.5 Million Offering

June 17, 2020

Neovasc Inc. (“Neovasc” or the “Company”), a leader in the development of minimally invasive transcatheter mitral valve replacement technologies, and minimally invasive devices for the treatment of refractory angina, announced today that it has closed its previously announced registered direct offering (the “Offering”) priced at-the-market under Nasdaq rules of an aggregate of 3,883,036 units (the “Units”) at a price of US$ 2.97375 per Unit for aggregate gross proceeds to the Company of approximately US$11.5 million, before deducting placement agent’s fees and estimated expenses of the Offering payable by the Company.

H.C. Wainwright & Co. acted as the exclusive placement agent for the Offering.

Each Unit consists of one common share of the Company and three-quarters of one warrant (each whole warrant, a “Warrant”) to purchase one common share. Each Warrant entitles the holder to acquire one common share of the Company at a price of US$ 2.88 at any time prior to June 16, 2025.

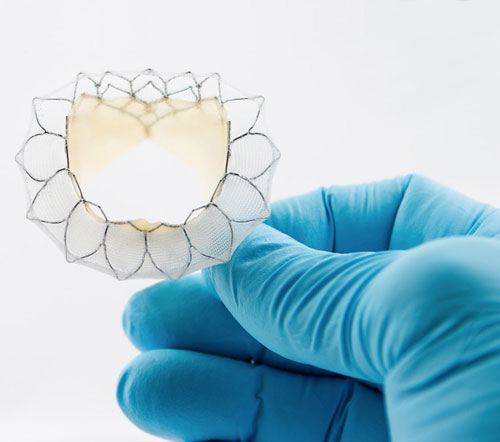

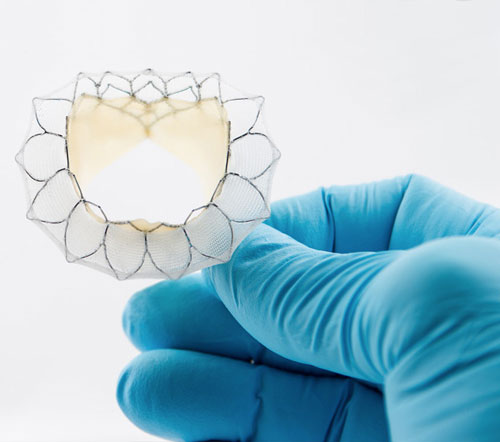

After deducting the placement agent’s fees and other offering expenses payable by Neovasc, the Company received net proceeds of approximately US$10.4 million. Neovasc intends to use the net proceeds from the Offering for the development and commercialization of the Neovasc Reducer™ (the “Reducer”), development of the Tiara™ (the “Tiara”) and general corporate and working capital purposes.

The Units and the securities comprising the Units were offered pursuant to a shelf registration statement (including a prospectus) previously filed with and declared effective by the Securities and Exchange Commission (the “SEC”) on July 13, 2018 and were qualified for distribution in each of the provinces of British Columbia, Alberta, Saskatchewan, Manitoba and Ontario by way of a final prospectus supplement to the Company’s base shelf prospectus dated July 12, 2018. The Company offered and sold the securities in the United States only. No securities were offered or sold to Canadian purchasers.

Source: Neovasc Announces Closing of $11.5 Million Registered Direct Offering Priced At-The-Market

Legacy MedSearch has more than 30 years of combined experience recruiting in the medical device industry. We pride ourselves on our professionalism and ability to communicate quickly and honestly with all parties in the hiring process. Our clients include both blue-chip companies and innovative startups within the MedTech space. Over the past 10 years, we have built one of the strongest networks of device professionals ranging from sales, marketing, research & , quality & regulatory, project management, field service, and clinical affairs.

We offer a variety of different solutions for hiring managers depending on the scope and scale of each individual search. We craft a personalized solution for each client and position with a focus on attracting the best possible talent in the shortest possible time frame.

Are you hiring?

Contact us to discuss partnering with Legacy MedSearch on your position.